In my previous post we talked about understanding the unique Financial Services Cloud (FSC) data model. Now that you’ve got Pardot implemented and connected with your Financial Services Cloud (FSC) instance, Pardot will allow you to automate and provide a customized level of service to your Financial Services clients.

Here are some quick marketing wins that will allow you to increase your sales pipeline in a matter of days using Pardot.

Use Case 1 – Webinar Execution and Follow-up

Applicable Industries: Banking, Wealth Management

During these challenging times virtual events will most certainly take the place of live events for the foreseeable future.

When executing a virtual event it’s absolutely critical that leads are handled effectively as every person is a new opportunity! Pardot is an ideal solution to engage your leads before and after your virtual event.

Here’s an example of how Pardot can be leveraged to engage leads after an event to drive more customer engagement and sales.

Initial Event Registration

WebEx, Go-To-Webinar, ReadyTalk, and Zoom all have Connectors to Pardot. Even if you are using a Webinar platform that does not have an integration with Pardot, you should be able to export the registration and attendee information and manually use the following steps.

Create two completion actions with Pardot:

Completion Action: Add all event registrations to a Dynamic List in Pardot.

Completion Action: Send registration Confirmation via Pardot.

Reminder Email

Using either Pardot Engagement Studio program or one-off List Emails, send reminders prior to the event.

Follow-Up after the Event

Using either Pardot Engagement Studio program or one-off List Emails send a follow-up after the event. Was there a call to action at the event such as a portfolio review? Use this email to remind the attendees of the call to action.

Advanced Options

Keep track of no-shows. Create a Suppression list for follow-up to exclude those from receiving follow-up email. And use a no-show list to send a “Sorry we missed you” email. Share a link to the recording or other resources that they may find valuable

Target Business Impact – 10% increase in marketing qualified leads

Use Case 2 – Increasing Client Account Reviews

Applicable Industries: Wealth Management, Asset Management, Private Banking, Insurance

Account reviews are a key component of the personalized banking and investment experience. As your client base grows it can be difficult to manually track when a client is due for an account review. Pardot is an ideal platform to automatically reach out to your clients for you to get an account review scheduled and share valuable resources.

Initial Set-Up

Set-Up a Dynamic List with segmentation criteria “Annual Review Due </= 60 days”

Create content called “Preparing for your Annual Review”

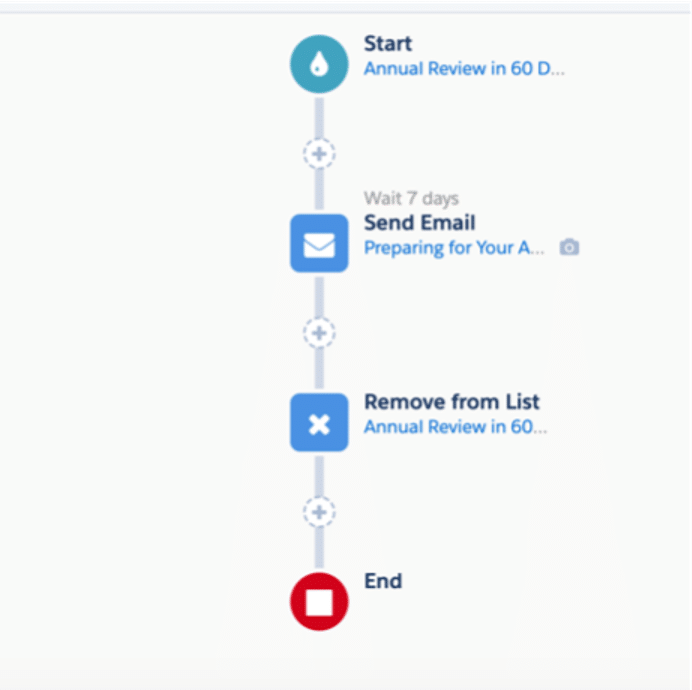

Engagement Studio Program

Set-up program where:

- Client is within 60 days of annual review (per dynamic list calculation above)

- Wait 7 days.

- Send Email “Preparing for your Annual Review”

- Depending on the Pardot Edition and other Salesforce tools, the client can exit the program here or they can be directed to set-up their preferred revue dates/times.

Target Business Impact – 8% increase in account reviews

Use Case 3 – Ensuring Lead Follow-Up by Sales

Applicable Industries: All industries including Real Estate and Insurance.

For this example, we’ll focus on the real estate industry even though a similar use case is possible across the financial services industry.

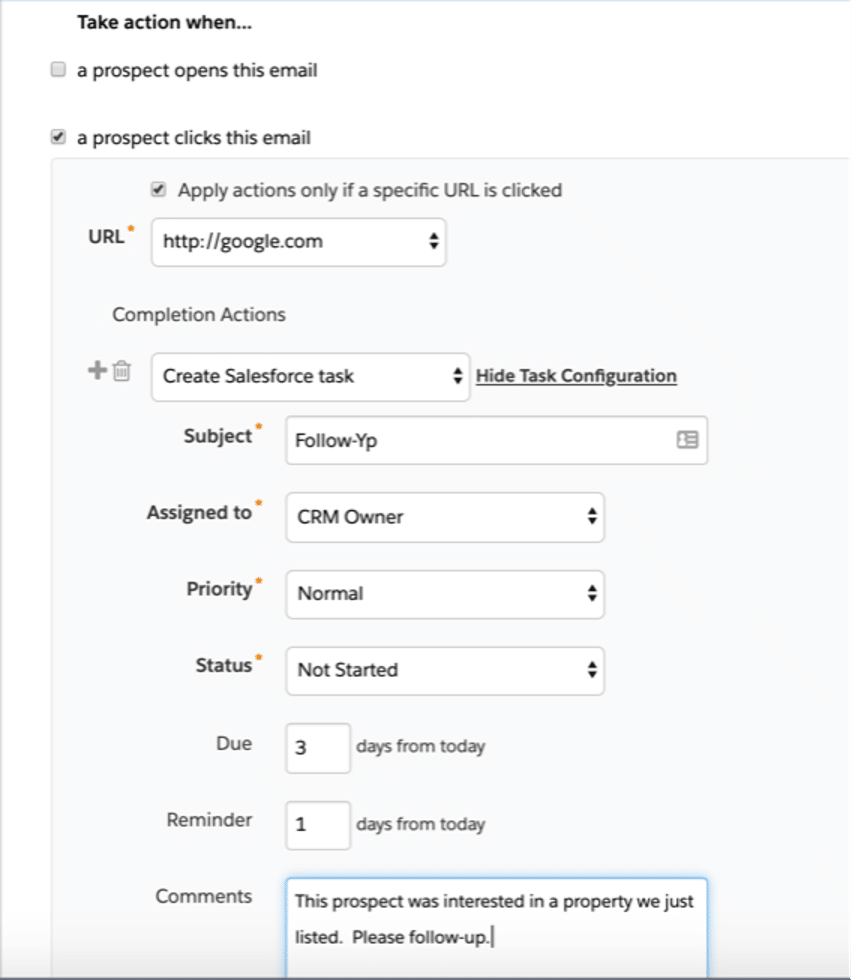

Let’s assume that your company is sending out a weekly email sharing various properties that are available for sale or rent to a segmented target audience. While this is a good start, what if you could notify individual sales reps when a newsletter recipient shows interest in a specific property by clicking through to the website listing.

With Pardot completion actions you can.

Set up a completion action as follows: Open Email or Click Link (whichever options fits your business and audience) followed by Notify User or Create Salesforce Task to have your sales team follow-up.

Your sales team will love the uptick in new leads!

Use Case 4 – Product Upsell or Cross-Sell

Applicable Industries: All industries, Insurance, Lending, Banking

Many companies find that their clients who have purchased a certain product (we’ll call it Product A) have a higher propensity to purchase additional products (we’ll call it Product B). We want to take advantage of this knowledge and automate sending content to the clients of Product A as to why Product B would be a natural next step.

Initial Set-Up

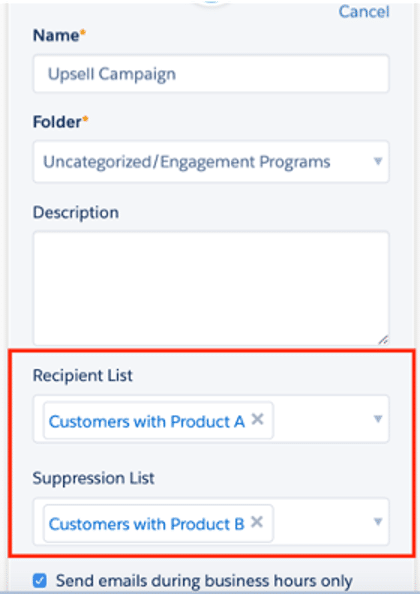

Create DYNAMIC LISTS in Pardot that are populating from Salesforce Data. Every product should have a corresponding DYNAMIC LIST that populates based on Salesforce status.

Content Creation

Have a series of content created as to why the clients of Product A should also be clients of Product B. This content can also be re-used (Pardot metrics will tell us whether the content was accessed. If not, the content can be resent. But we will keep the illustration simple here.)

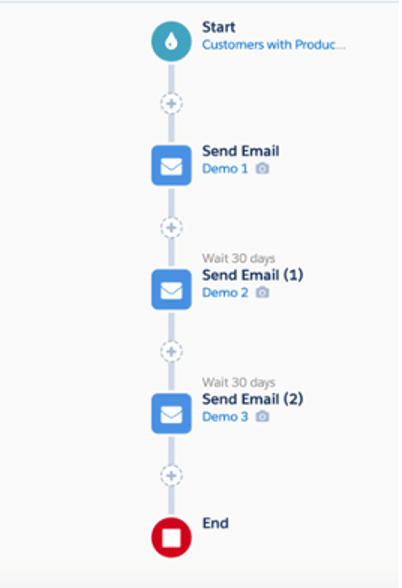

Pardot Engagement Studio

We will utilize a target list (clients with Product A) and a suppression list of those clients that already have Product B. As mentioned in the Initial Set-Up, as the lists are tied directly to the Salesforce status, when an A-Product Client does purchase B-Product, they are then moved over to the suppression list and exit the campaign.

This campaign is set up to send content once a month until they purchase B-product.

Target business impact – 2% – 3% increase in net new cross-sell/up-sell opportunities

In our next post, we’ll talk about Pardot for the Mortgage industry and how the solutions can be used to keep applicants moving through the process as well as closing net new business.

Looking to get more value out of Pardot in the meantime? Sign-up for a complimentary Pardot assessment to start driving more business within 14-days. Invado Solutions’ Pardot consultants can help you in setting up Pardot to run your marketing campaigns more effectively.